After the reverse home loan profits settle the existing mortgage, the foreclosure stops and you won't have to make anymore month-to-month payments. Sounds pretty great, ideal? However there are drawbacks to utilizing a reverse mortgage in this way. One downside is that the borrower loses some or the majority of the equity that's developed throughout the years.

Likewise, the reverse home loan lending institution can call the loan due if and when among the following events takes place: The customer completely vacates timeshare movie the home. The borrower moves out of the house short-term due to a physical or mental disorder, and is chosen over a year. The customer sells the home or deeds the house to a brand-new owner.

(If a qualified non-borrowing partner still resides in the house, the lending institution can't call the loan due under particular scenarios). The borrower doesn't fulfill the home loan requirements, like paying real estate tax, having property owners' insurance coverage on the home, and keeping the home in good condition. who took over abn amro mortgages. As soon as the loan provider calls the loan due, the loan needs to be repaid or the loan provider will foreclose.

A reverse home mortgage is only one method to prevent a foreclosure. A few other alternatives to think about are: re-financing the existing home loan getting a home mortgage modification, or selling the home and transferring to more cost effective accommodations. The Consumer Financial Defense Bureau offers an useful reverse home mortgage conversation guide and recommends customers who are thinking about securing a reverse mortgage to think about all other options - how many mortgages to apply for.

Some Of Who Is Specialty Services For Home Mortgages ?

Although you'll have to finish a therapy session with a HUD-approved therapist if you desire to get a HECM, it's also highly suggested that you consider speaking with a financial planner, an estate planning attorney, or a customer security attorney prior to securing this sort of loan - how to compare mortgages excel with pmi and taxes.

A new extensive investigation on foreclosure actions connected to reverse home mortgages released late Tuesday by USA Today paints a bleak picture surrounding the activities and practices of the reverse home loan industry, however also more info relates some doubtful and obsolete information in essential areas highlighted by the investigation, according to industry participants who consulted with RMD.

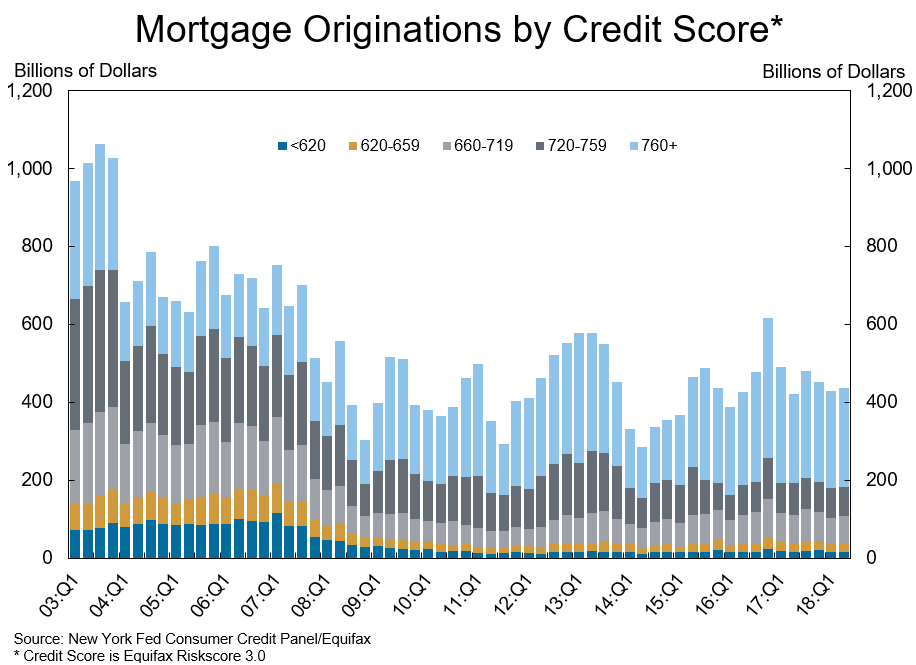

Referring to a wave of reverse home mortgage foreclosures that primarily impacted urban African-American areas as a "stealth aftershock of the Great Economic downturn," the investigative post focuses on nearly 100,000 foreclosed reverse home loans as having "failed," and affecting the financial futures of the borrowers, negatively affecting the property worths in the neighborhoods that surround the foreclosed properties.